As the financial sector wrestles to get its head around the implications of Blockchain, the mechanism for Bitcoin, its applications are spreading across industries.

Blockchain is a vast online public ledger, which was created to keep a record of who owns, and has ever owned, Bitcoins. Its records are near impossible to fabricate which makes them invaluable as a matter of record.

Governments have seized on this and are looking at Blockchain for everything from recording land registries to sharing personal health records. While the Bank of England is among those investigating how it could form the basis of a new global payments system. Today almost every industry seems to be looking at what Blockchain could mean for them

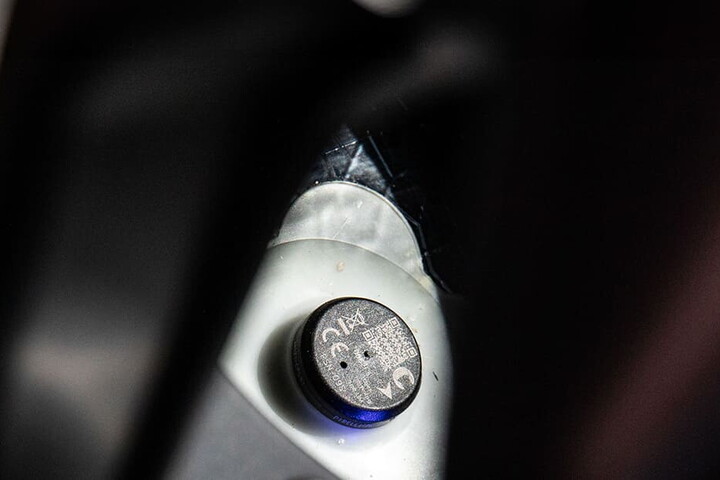

One example comes from the world of car leasing. The US technology company DocuSign formed a partnership with Visa last year to explore how to simplify the car leasing business. They realised the paperwork and processes involved in leasing a car puts many people off. So they are using Blockchain to register the car's identity while the customer chooses the lease options and signs the leasing contract, which is all updated on the Blockchain record.

Meanwhile US telecommunications company Verizon's venture capital arm is exploring what Blockchain could mean for its business when united with the Internet of Things.

The trust machine

These possibilities are no surprise to David Yermack, professor of business and finance transformation at the Stern School of Business in New York, who believes Blockchain will have a profound impact on industry and commerce.

“The Economist called Blockchain a trust machine,” he says. “Its advantage is that it cannot be rewritten and it is time-stamped, which gives proof of ownership and a full custody history. Anyone running a database might want to look at what Blockchain can do for them.”

One non-financial area in which Blockchain is already taking off is the art market, where it is being used to authenticate ownership, tackle money laundering and even eliminate fakes.

When it comes to art, record-keeping is often poor and what there is can be faked. The market is huge – according to Bloomberg its annual value hit $67 billion (£46.5 billion) in 2014 – and unregulated. As a result, it is seen as an easy way to launder money. After guns and drugs, stolen and faked art is the biggest criminal enterprise in the world. Blockchain could change all that.

Verisart, a Los Angeles-based start-up, wants to use it to build a global ledger of art and collectables that can offer authentication in real time. But why stop there? The luxury goods market is also rife with counterfeiting. Famous fashion luxury brands could use Blockchain to authenticate their products. “It does seem like a logical extension,” Yermack says.

Not only would such authentication make it more difficult for the counterfeiters to sell to unwitting consumers, but it would also guarantee provenance. This is key in the fight against criminals involved in selling blood diamonds and stolen artworks, for example, the proceeds of which often end up in the hands of terrorists and militia.

But Blockchain is not just about authenticating luxury goods – it can also be used to check the authenticity of products for which the maintenance of high standards could be a matter of life and death.

With more medicines sold through non-traditional channels, counterfeiters are better able to infiltrate the system – to the extent that some $200 billion (£138 billion) worth of medicines are estimated to be fakes. But Blockchain allows buyers to check the provenance of a pharmaceutical product and thereby avoid them.

Similarly, cars will be able to make available their complete histories, including accidents, mileage and service, so it is easier to value them and ensure their safety. Insurance companies will be able to check these records against claims to weed out fraud, helping to keep premiums down.

Private property

It's not all good news, however. The rise of Blockchain will doubtless impinge on personal privacy as every detail of our lives is recorded, including education, employment history, criminal and health records and what we buy. “As we realise its full potential there will be more questions about its effects on privacy and trust,” acknowledges Yermack.

There is also the problem of running the system and maintaining its integrity. Currently there are two main Blockchain systems – the original, permission-less one and systems where access is controlled by a gatekeeper. While the permission-less system has high security, its resource demands are prohibitively high. But the permission system suffers from trust issues and a potential for corruption.

“If you can corrupt the gatekeeper you can tamper with the data,” explains Yermack. “And while there's talk of getting an international organisation like Unesco to run a permission Blockchain, such a move would only highlight political and economic rivalry between the different global powers.”

Who knows exactly where Blockchain is going to take us; it's less than 10 years old, after all. What is clear is that it will simplify the authentication process and this will have an impact on criminal and fraudulent activity… at least for a while.