Self-driving robotaxis are being hailed not only as the transport solution of the future but also the saviour of the hard-pressed car-making industry. And it is scores of small-scale pioneering technology companies working at the outer edges of autonomous vehicle research that look like making possible this new direction for mobility.

Many are led by owners who are bringing their personal passion to areas such as mapping, camera recognition, sensors, data crunching and communicating with other vehicles. And, by contributing a highly specialised part of a complex jigsaw, they are developing the skills and technology that car makers need as they seek to keep up with the trend towards autonomous vehicles.

Among the growing ecosystem of start-ups that can be found mostly in the United States but also around the world, is London-based Scape Technologies, which has an innovative approach to making sure vehicles such as driverless cars know exactly where they are. Founded just three years ago, Scape has developed technology that provides “centimetre-level location recognition at a previously unprecedented scale”.

Innovative approaches

Hugely detailed three-dimensional mapping has been seen as essential for autonomous vehicles to make sure they keep to road lanes and speed limits, obey traffic lights and other road requirements. The problem has been that such maps can be huge data files. If they have to be carried on board they run the risk of quickly becoming obsolete. But storing them in the cloud requires totally reliable, superfast, high-capacity data links that are virtually impossible to guarantee. Any system then needs constant cross-checking with a global positioning system such as the American GPS or Russian Glonass, military systems that are purposely made less precise for civil applications.

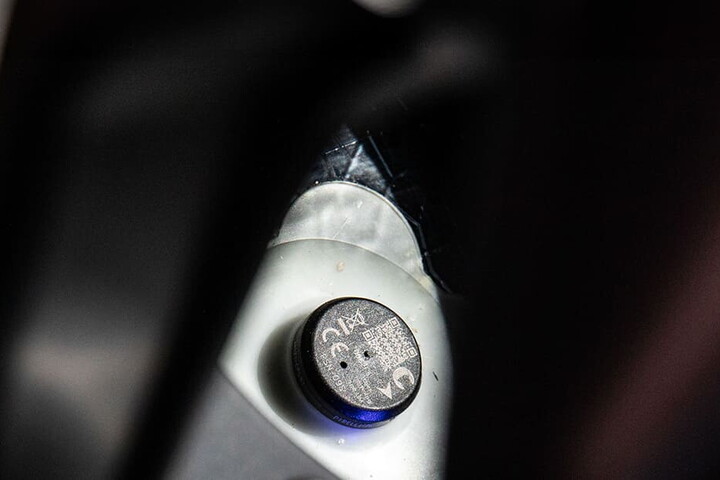

Scape co-founder and chief executive Edward Miller says that GPS and electronic compasses – like the kind found in smartphones – “are not sufficiently accurate to enable the next wave of computing”. So his company has built a “visual-based positioning service”. It constructs a 3D map in the cloud, using still and video images from a variety of sources. That means it can then pinpoint the location of any device using just the images transmitted by that device's camera.

Currently London is the only city Scape has mapped, and the two to three seconds that it takes to plot location on a 3G connection is fine for shared bicycles, say, but not for guiding driverless cabs moving at 29 feet per second, or 20mph. But faster plotting should be achievable and Scape, which recently raised $8m in seed funding, says other cities are in the pipeline.

It is perhaps over-optimistic to assume that Scape's camera technology could eliminate all the sensors, radar and laser-ranging systems that are employed on current driverless car prototypes, because the vehicles need to be able to react to children running out in front of them, for example. But Scape's innovation is just the sort of technology that is being taken up enthusiastically by big car companies as they seek to claim a stake in the future of mobility.

Transport overhaul

For cities that future is “seamless urban mobility”, according to a report this year by global consultancy McKinsey, which means encouraging autonomous and electric vehicles with incentives and regulation as part of an integrated transport overhaul. The main alternatives would be to do nothing and allow the number of vehicles powered by internal-combustion engines to rise along with rising populations, or to permit autonomous buses and robotaxis but not integrate them into an overall transport plan. The first option would bring extra pollution along with extra congestion. The second would bring extra congestion.

Meanwhile car makers can now dream of getting away from their capital-intensive traditional business into the sort of margins considered likely on mobility services – which have been estimated by Ford and others as reaching 20 per cent.

The overall potential is huge. Chipmaker Intel, which has bought heavily into the idea, says the autonomous vehicle sector will generate $7 trillion a year by 2050. And Waymo is certainly showing the way. The subsidiary of Google owner Alphabet started working on autonomous driving technology and capability only 10 years ago and is now valued at as much at $250 billion.

Shaping the future

With such high stakes, there is a huge demand for breakthrough technology. Another start-up illustrates the potential. In less than two decades, Mobileye went from being an Israeli academic's research project, using algorithms to identify hazards from vehicles, pedestrians and road signs in a camera feed, to a system used on millions of vehicles. The company was snapped up by Intel in 2017 for $15.3 billion.

Mobileye's technology is used extensively by vehicle manufacturers for existing driver-assistance features such as adaptive cruise control and emergency braking. But driverless vehicles are the real prize and the company is now working with Intel and BMW on an autonomous driving system that is intended to be in production cars by 2021.

Meanwhile the announcement by BMW and Mercedes that they are merging their car-sharing, ride-hailing, charging and parking services underlines the car makers' determination to claim the mobility space.

Car companies know they need to get in on the ground floor with robotaxis and not just as suppliers of cars to be converted into autonomous vehicles – margins on fleet sales are poor. If they want to stay in the transport business they need to integrate the work of technology pioneers. And that is where companies such as Scape, Mobileye and the many other new car sector start-ups come into the picture.